WANT TO JOIN OUR INCREASED INCOME

REVOLUTION?

Our focus is on helping landlords get the most out of their properties,and increase cashflow by managing their properties on

their behalf as serviced apartments.

Here at Statera, we pride ourselves on being different. Being property investors ourselves, we understand the value of our client's investment in their properties and assets. This is why everything that we do is all about striking a balance - [Statera], creating win-win situations that will allow us to be satisfied with the returns on our service, while at the same time giving our landlords and investors more money

in their pockets than traditional agents can offer. Our landlords enjoy the benefit of having the piece of mind that their investment is being handled with the care and attention that it deserves.

"WE ARE PUTTING THE EARNINGS BACK INTO THE POCKETS OF LANDLORDS AND INVESTORS".

WHY HOMEOWNERS CHOOSE STATERA ESTATES

Statera Estate is a full service agency. This means once you start to work with us, we take over every single part of managing your property as a predictably profitable business, and you can be rest assured that your property is in great condition and maximising on it's potential. Your money will come into your bank account monthly and on time, all without you having to invest any of your precious time

.

EARN AND LEARN

Landlords who work with us,

will not only have thepotential to benefit from an increased cashflow , but theywill also get tolearn the process, andshould they decide they want to do it alone in the future,they will be equipped to do so

TIME FREEDOM

More profits generally means more work, but here's the reality that we're all to familiar with, most Landlords did not get into property to create a second job for themselves. Marketing, managing bookings, handling the cleaners and maintenance team as well as guest communication are some of the things we take away from you, giving you back your time freedom.

OUR EXPERTISE

Not everyone knows how to transform their property into a proper business. You can leverage our expertise in how to understand if there is demand for serviced apartments in your location,how to attract guests on a consistent basis to maximise your income potential, and then finally how to manage the whole process

LEGISLATIVE BENEFITS

EPC 2025

With over 3 million homes falling short of the new epc standard from 2025 (costing them on average £8000), it's no wonder many landlords are now coming to us to help them get around this by using our serviced accommodation model

Section 21

With the rising inflation and the cost of living increase, landlords can not afford for their tenants to miss payments, and to make matters worse, it is taking an average of 12 months to evict tenants at the moment. We can help you avoid this with our serviced accommodation model

Section 24

Want to save on tax? Even if you're not registered as a limited company?Another reason our landlords are overjoyed with us. Get in touch to see how we can do the same for you.

TAX BENEFITS

Capital Gains Tax Reliefs

The good news about having a SA is you can claim a range of tax reliefs that are usually reserved for traders. These include Entrepreneur’s Relief, Hold Over Relief, Relief for Gifts of Business Assets, Relief for Loans to Traders and Roll Over Relief.

Capital Allowances

As the owner of a Serviced apartment, you are allowed to claim Capital Allowance for items such as equipment, household fixtures and furniture. This means that if you decide to go to town with decorating and furnishing your SA, you will be able to deduct these costs from your pre-tax profits.

Pension Contribution

Any profit that you make from your SA is considered as ‘relevant earnings’ which means you can make tax-advantaged pension contributions.

Council Tax or Business Rates

Serviced apartments do not pay council tax. As the owner of a SA you should register for business rates, which will be calculated by your local council. In general, these rates will be lower than council tax.

BTL vs SA

Increased profits

Typically, the same property will generate 2/3x more profit for the landlord or investor, opening many more options for them.

No more nonpaying tenants

With a BTL, you have a contract in place that if the tenant breaks, it takes about 12 months to actually evict them. As a Serviced Accommodation provider, you have no tenants but instead you have guests that pay you even before they arrive.

Property in pristine condition at all times

Due to the nature of the business, Serviced Accommodation properties have to be kept in pristine condition at all times, whilst it's difficult to predict what your property will look like at the end of a tenancy, generally, you will be planning for the worst

More control

Our landlords have full control of their property, many of them for the first time in years. With our services, you decide when it's occupied and when you want to keep it available for yourself, whether that is to host family, guests, it doesn't matter what you need it for, the fact is it is in your complete control with the utmost flexibility to use your asset to it's best advantage.

WHERE DO WE LIST YOUR PROPERTY

OUR PARTNERS:

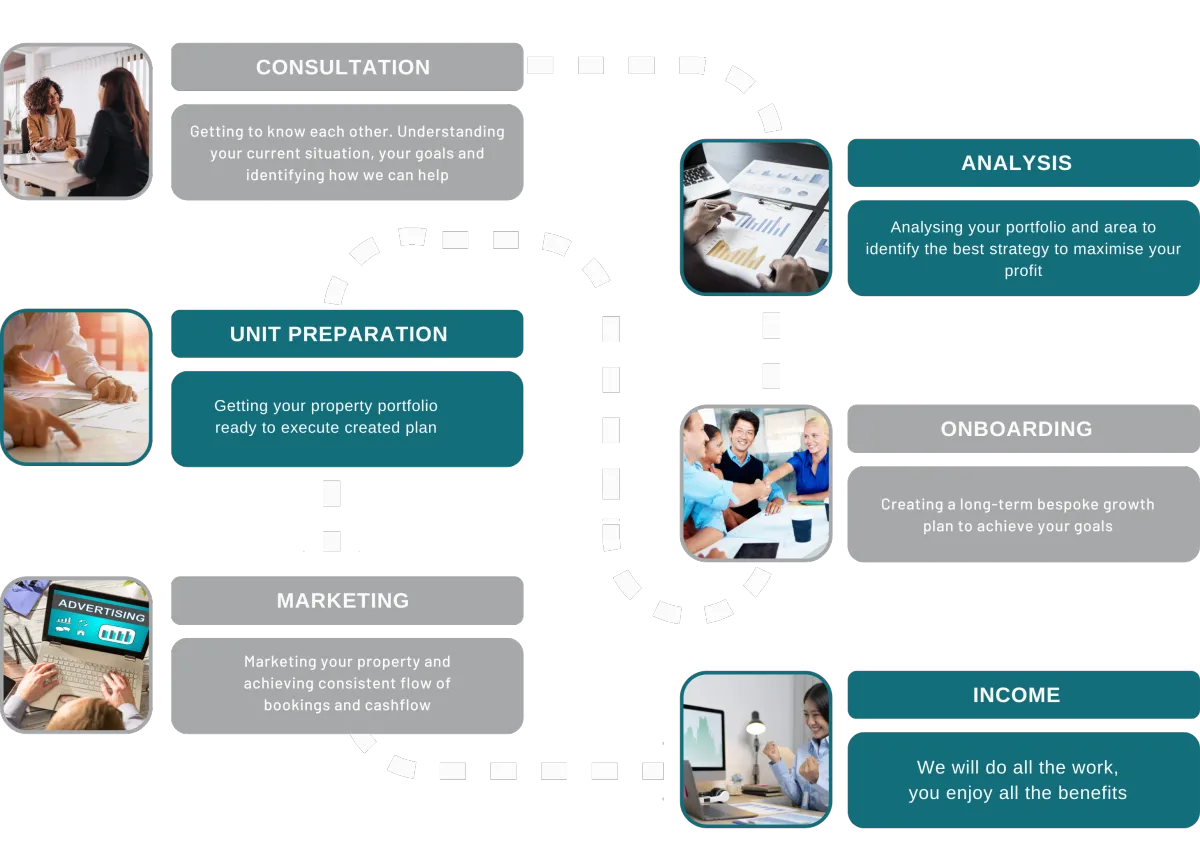

HOW IT WORKS

LISTING MANAGEMENT

Optimised for maximum returns.

Maximising occupancy

We'll offer your property on a variety of sites to maximise your booking and revenue potential. Your calendar is synchronised across all of them thanks to our technology, and you get fantastic returns. To assure occupancy all year long, we also concentrate on the corporate market.

Professional photography

With expert photography, we'll raise your occupancy rate and the amount you may charge.

Listing creation and optimisation

We'll set up and create your listings on several platforms in order to improve the amount of reservations and assist attract the correct visitors to your home. Since we have years of experience, we are aware of what is most effective.

Profit growth

We focus on helping you enhance your property's income by effectively pricing it and taking advantage of periods of strong demand. We have both the data and the excellent human ideas that are the foundation of every successful pricing plan.

GUEST MANAGEMENT

Ensuring a 5-star guest stay.

Guest vetting

Your safety and the security of your property are our top priority. We screen all guests.

Check-in and smart-locks

Easy self check-in is a top priority for guests and the Airbnb algorithm loves it too! So we support you through out smart-lock installation process and provide software that will not only to provide guest with easy check in option but also will increase security for your property.

Linen and toiletries

Guests always remember how good the sheets are! We provide hotel quality linen and a high-quality laundry service. Our housekeepers know all the perfect touches for an enjoyable guest stay.

Guest communication

Responding to guests as quickly as possible is the key to getting more bookings and maintaining a good reputation. Our teams respond 24/7/365 and trained to deal with all questions and issues both before and during stays.

PROPERTY MANAGEMENT

Taking care of your property.

Cleaning and housekeeping

5-star Cleans from our Professional Housekeepers. We've work with Airbnb cleaning service providers that are tried and tested with time, to ensure every clean is done thoroughly with guests in mind and are never missed! Cleaners even report back to HQ with photos.

Maintenance

Our housekeeping team take photographs between each guest stay and report on any maintenance items. If it's a small item, we'll fix it quickly. If it's something that needs repairing or replacing, such as washing machine, we can arrange this for you.

Deposits

We take security deposits from all guests for every booking. This protects our downside and keeps the guests accountable.

Reports

Our Dashboard syncs your calendar between multiple booking websites to give you more control and see who is staying. You can also track your performance and income. Clear and transparent.

MAKE YOUR FIRST STEP TO ACHIEVING YOUR FINANCIAL GOALS

Planning permission for Airbnb

As the sharing economy continues to grow, more and more people are turning to platforms like Airbnb to rent out their homes and make extra income. However, in many cases, these renters are doing so without obtaining the necessary planning permission from their local authorities.

This lack of planning permission can cause a number of problems, both for the renters and their neighbors. In some cases, the rentals may be illegal and subject to fines or other penalties. Additionally, the influx of short-term renters can disrupt the peace and quiet of residential neighborhoods, leading to complaints and conflicts.

So why are so many people renting out their homes on Airbnb without planning permission? The main reason is that many people are simply unaware that they need it. In many cases, they believe that as long as they are not causing any problems, they are within their rights to rent out their homes on a short-term basis.

However, this is not always the case. Most local authorities require that homeowners obtain planning permission before they can legally rent out their homes on a short-term basis. This is because short-term rentals can have a number of impacts on the surrounding community, including increased traffic, noise, and waste.

In order to obtain planning permission, homeowners must submit a written application to their local authority. This application must include detailed information about the property, including its location, size, and any other relevant details. The application must also include a statement outlining the reasons for the proposed rental, and how the property will be managed and maintained.

Once the application is submitted, it will be reviewed by the local authority. If the application is approved, the homeowner will be granted planning permission to rent out their property on a short-term basis. However, if the application is denied, the homeowner will not be able to legally rent out their property on Airbnb or any other short-term rental platform.

So what happens if a homeowner rents out their property on Airbnb without planning permission? In most cases, the local authority will become aware of the rental through complaints from neighbors or other sources. Once this happens, the authority will investigate the situation and determine whether or not the rental is illegal.

If the rental is found to be illegal, the homeowner may face a number of penalties. These can include fines, legal action, and even the revocation of their planning permission. In some cases, the homeowner may be required to pay back any income they have earned from the illegal rental.

In addition to the potential penalties, renting out a property on Airbnb without planning permission can also cause problems for the renters themselves. For example, if the rental is found to be illegal, the renters may be asked to vacate the property immediately. This can cause significant inconvenience and financial loss for the renters, who may have already paid for their stay.

So what can homeowners do to avoid these potential problems? The best course of action is to obtain planning permission before renting out their property on Airbnb or any other short-term rental platform. This will ensure that the rental is legal, and will protect both the homeowner and the renters from potential penalties and other problems.

In order to obtain planning permission, homeowners should contact their local authority and ask for information on the process. The authority will be able to provide detailed instructions on how to submit a written application, as well as any other requirements that may be necessary.

Once the application has been submitted, the homeowner should be prepared to wait for a response. The review process can take several weeks or even months, depending on the complexity of the application and the workload of the local authority.

Once planning permission has been granted, the homeowner can begin to rent out their property on Airbnb or any other short-term rental platform.

HERE

HIM DECIDING TO GO FOR A

TRADITIONAL RENTAL VS USING OUR SERVICES

90%

Occupancy rate

2X

Profit comparing to BTL

9.5

Excellent on Booking.com

Godwin

"Before I came across Statera Estates I had this property vacant for 2 years. I was starting to get frustrated and was thinking about selling because I did not want to go back to dealing with regular tenants. If someone had told me 2 years ago that I could make more than double the profits on this property and not having to deal with tenants, I would have never believed them, but that is exactly what has happened. My property is looking the best it ever has, always book booked out and I never have to ask any questions because I have my own portal which allows me to see exactly what is happening at any given point. I could not recommend this company highly enough!"

USEFUL TO KNOW

Lots of landlords are unaware of the potential to increase the income they generate from their properties. So much so that a whole new income strategy has come out of this lack of knowledge, called rent-to-rent.

This is where landlords are offered guaranteed rent for a fixed term, this could be anywhere from 12 - 60 months, the landlord then allows the service provider to sublet the property, which they then turn into serviced apartments. In theory, there are benefits to the landlord, as they no longer have to worry about void periods, management, evictions etc. The difference between what the service provider

rents the property from the landlord for, and what they are able to get on the open market, is theirs to keep as profit

.

AT STATERA ESTATES, WE BELIEVE THERE IS A BETTER WAY!

Having worked with many investors, we understand the landlords journey, the sacrifices they have made to put themselves on the ladder, and as such we believe it is unfair that so many property investors and landlords are missing out on the opportunity to maximise on the investment that they’ve worked very hard to attain, while others are often times making more money from their properties than they are as landlords and investors.

GET THE MOST OUT OF YOUR PROPERTY

INCREASE YOUR CASHFLOW

MORE TIME, WE MANAGE IT FOR YOU

CUTTING OUT THE MIDDLEMAN

LEGISLATION AND TAX BENEFITS

We decided that we will focus on helping landlords get the most out of their properties and increase cash flow by managing their properties on their behalf as serviced apartments, and in the process, cutting out the middleman. This puts the control back into their hands as they are now able to benefit from all the legislation that doesn't apply to using your property as a serviced apartment.

WANT TO JOIN OUR INCREASED INCOME REVOLUTION?

TERMS &

CONDITIONS

PRIVACY POLICY

Statera Estates LTD is a company incorporated in England and Wales with registered number 14204437 and registered offices at 2627, 321-323 High Road, Chadwell Heath, Romford, Essex, RM6 6AX, United Kingdom.

Statera Estates LTD is registered with the Information Commissioner’s Office, with registration number ZB361736

Statera Estates LTD is a member of The Property Ombudsman Scheme, with membership No. T08031.