WANT TO JOIN OUR INCREASED INCOME

REVOLUTION?

Our focus is on helping landlords get the most out of their properties,and increase cashflow by managing their properties on

their behalf as serviced apartments.

Here at Statera, we pride ourselves on being different. Being property investors ourselves, we understand the value of our client's investment in their properties and assets. This is why everything that we do is all about striking a balance - [Statera], creating win-win situations that will allow us to be satisfied with the returns on our service, while at the same time giving our landlords and investors more money

in their pockets than traditional agents can offer. Our landlords enjoy the benefit of having the piece of mind that their investment is being handled with the care and attention that it deserves.

"WE ARE PUTTING THE EARNINGS BACK INTO THE POCKETS OF LANDLORDS AND INVESTORS".

WHY HOMEOWNERS CHOOSE STATERA ESTATES

Statera Estate is a full service agency. This means once you start to work with us, we take over every single part of managing your property as a predictably profitable business, and you can be rest assured that your property is in great condition and maximising on it's potential. Your money will come into your bank account monthly and on time, all without you having to invest any of your precious time

.

EARN AND LEARN

Landlords who work with us,

will not only have thepotential to benefit from an increased cashflow , but theywill also get tolearn the process, andshould they decide they want to do it alone in the future,they will be equipped to do so

TIME FREEDOM

More profits generally means more work, but here's the reality that we're all to familiar with, most Landlords did not get into property to create a second job for themselves. Marketing, managing bookings, handling the cleaners and maintenance team as well as guest communication are some of the things we take away from you, giving you back your time freedom.

OUR EXPERTISE

Not everyone knows how to transform their property into a proper business. You can leverage our expertise in how to understand if there is demand for serviced apartments in your location,how to attract guests on a consistent basis to maximise your income potential, and then finally how to manage the whole process

LEGISLATIVE BENEFITS

EPC 2025

With over 3 million homes falling short of the new epc standard from 2025 (costing them on average £8000), it's no wonder many landlords are now coming to us to help them get around this by using our serviced accommodation model

Section 21

With the rising inflation and the cost of living increase, landlords can not afford for their tenants to miss payments, and to make matters worse, it is taking an average of 12 months to evict tenants at the moment. We can help you avoid this with our serviced accommodation model

Section 24

Want to save on tax? Even if you're not registered as a limited company?Another reason our landlords are overjoyed with us. Get in touch to see how we can do the same for you.

TAX BENEFITS

Capital Gains Tax Reliefs

The good news about having a SA is you can claim a range of tax reliefs that are usually reserved for traders. These include Entrepreneur’s Relief, Hold Over Relief, Relief for Gifts of Business Assets, Relief for Loans to Traders and Roll Over Relief.

Capital Allowances

As the owner of a Serviced apartment, you are allowed to claim Capital Allowance for items such as equipment, household fixtures and furniture. This means that if you decide to go to town with decorating and furnishing your SA, you will be able to deduct these costs from your pre-tax profits.

Pension Contribution

Any profit that you make from your SA is considered as ‘relevant earnings’ which means you can make tax-advantaged pension contributions.

Council Tax or Business Rates

Serviced apartments do not pay council tax. As the owner of a SA you should register for business rates, which will be calculated by your local council. In general, these rates will be lower than council tax.

BTL vs SA

Increased profits

Typically, the same property will generate 2/3x more profit for the landlord or investor, opening many more options for them.

No more nonpaying tenants

With a BTL, you have a contract in place that if the tenant breaks, it takes about 12 months to actually evict them. As a Serviced Accommodation provider, you have no tenants but instead you have guests that pay you even before they arrive.

Property in pristine condition at all times

Due to the nature of the business, Serviced Accommodation properties have to be kept in pristine condition at all times, whilst it's difficult to predict what your property will look like at the end of a tenancy, generally, you will be planning for the worst

More control

Our landlords have full control of their property, many of them for the first time in years. With our services, you decide when it's occupied and when you want to keep it available for yourself, whether that is to host family, guests, it doesn't matter what you need it for, the fact is it is in your complete control with the utmost flexibility to use your asset to it's best advantage.

WHERE DO WE LIST YOUR PROPERTY

OUR PARTNERS:

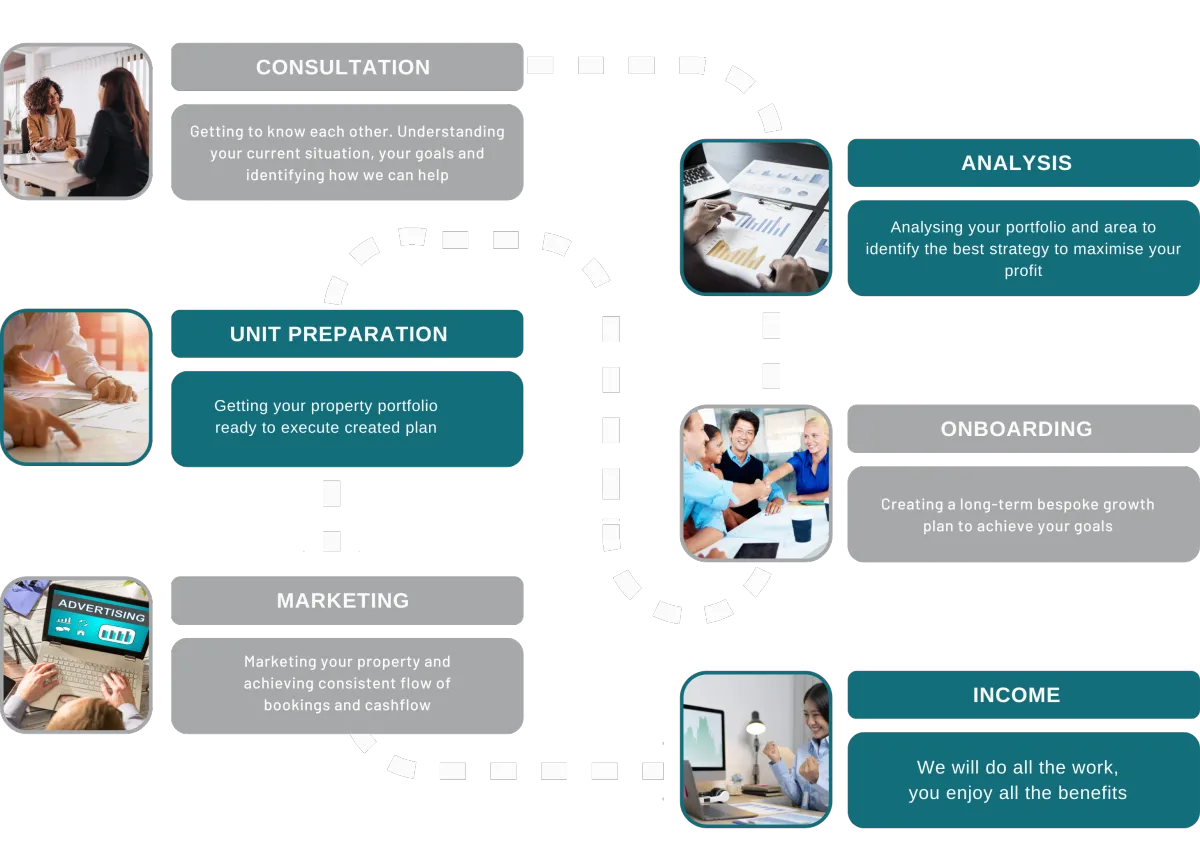

HOW IT WORKS

LISTING MANAGEMENT

Optimised for maximum returns.

Maximising occupancy

We'll offer your property on a variety of sites to maximise your booking and revenue potential. Your calendar is synchronised across all of them thanks to our technology, and you get fantastic returns. To assure occupancy all year long, we also concentrate on the corporate market.

Professional photography

With expert photography, we'll raise your occupancy rate and the amount you may charge.

Listing creation and optimisation

We'll set up and create your listings on several platforms in order to improve the amount of reservations and assist attract the correct visitors to your home. Since we have years of experience, we are aware of what is most effective.

Profit growth

We focus on helping you enhance your property's income by effectively pricing it and taking advantage of periods of strong demand. We have both the data and the excellent human ideas that are the foundation of every successful pricing plan.

GUEST MANAGEMENT

Ensuring a 5-star guest stay.

Guest vetting

Your safety and the security of your property are our top priority. We screen all guests.

Check-in and smart-locks

Easy self check-in is a top priority for guests and the Airbnb algorithm loves it too! So we support you through out smart-lock installation process and provide software that will not only to provide guest with easy check in option but also will increase security for your property.

Linen and toiletries

Guests always remember how good the sheets are! We provide hotel quality linen and a high-quality laundry service. Our housekeepers know all the perfect touches for an enjoyable guest stay.

Guest communication

Responding to guests as quickly as possible is the key to getting more bookings and maintaining a good reputation. Our teams respond 24/7/365 and trained to deal with all questions and issues both before and during stays.

PROPERTY MANAGEMENT

Taking care of your property.

Cleaning and housekeeping

5-star Cleans from our Professional Housekeepers. We've work with Airbnb cleaning service providers that are tried and tested with time, to ensure every clean is done thoroughly with guests in mind and are never missed! Cleaners even report back to HQ with photos.

Maintenance

Our housekeeping team take photographs between each guest stay and report on any maintenance items. If it's a small item, we'll fix it quickly. If it's something that needs repairing or replacing, such as washing machine, we can arrange this for you.

Deposits

We take security deposits from all guests for every booking. This protects our downside and keeps the guests accountable.

Reports

Our Dashboard syncs your calendar between multiple booking websites to give you more control and see who is staying. You can also track your performance and income. Clear and transparent.

MAKE YOUR FIRST STEP TO ACHIEVING YOUR FINANCIAL GOALS

Why 2025 Is the Year for Portfolio Diversification: Serviced vs Traditional Properties Explained

If you're a UK landlord still relying solely on traditional long-term rentals, 2025 might be the wake-up call you need. The property investment landscape has shifted dramatically, and smart investors are already diversifying their portfolios to include short-term rentals alongside their traditional lets. Here's why this year presents the perfect storm of opportunities for portfolio diversification: and why serviced apartments could be your ticket to higher returns.

The Market Reality Check: Why Traditional Rentals Aren't Enough Anymore

Let's be honest: the traditional rental market has become increasingly challenging. With rising mortgage rates, stricter regulations, and tenant-friendly policies that can leave landlords vulnerable to extended void periods, relying on just one rental strategy feels a bit like putting all your eggs in one basket.

The economic volatility we're seeing in 2025 has made diversification not just smart, but essential. While traditional rentals offer steady income, they're also subject to rent caps, lengthy notice periods for possession, and the risk of problematic tenants who can cost thousands in lost rent and property damage.

Meanwhile, the short-term rental market has matured into a legitimate, profitable alternative that many landlords are now treating as a serious investment strategy rather than a side hustle. The numbers don't lie: properties optimized for short-term lets often achieve 20-40% higher gross yields compared to traditional rentals, especially in high-demand areas.

Understanding the Serviced Apartment Advantage

Serviced apartments and short-term rentals operate on fundamentally different principles than traditional lets. Instead of locking in one tenant for 12 months at a fixed rate, you're essentially running a small hospitality business that can adapt pricing based on demand, seasonality, and local events.

The key advantages include:

Dynamic Pricing Power: Unlike traditional rentals where rent reviews happen annually (if you're lucky), short-term rentals allow you to adjust rates weekly or even daily. Christmas week in London? Double your rates. Summer festival in Edinburgh? Premium pricing applies. This flexibility means you can maximize revenue during peak periods while staying competitive during quieter times.

Shorter Commitment Periods: If a guest becomes problematic, they're gone in a few days rather than requiring months of legal proceedings. This dramatically reduces your exposure to difficult occupants and property damage.

Higher Revenue Potential: Quality serviced apartments in desirable locations consistently outperform traditional rentals. We regularly see properties generating 25-35% more gross income when managed properly for short-term stays.

The 2025 Market Dynamics Favoring Short-Term Lets

Several trends converging in 2025 make this an ideal time to diversify into serviced apartments:

Remote Work Revolution: The hybrid working model has created new travel patterns. Business travelers now book longer stays (3-7 nights) in serviced apartments rather than hotels, seeking space to work and more amenities. This segment pays premium rates and treats properties with more care than typical tourists.

Leisure Travel Recovery: Post-pandemic leisure travel has rebounded strongly, but traveler preferences have shifted toward private accommodations. Families and groups prefer the space and privacy of serviced apartments over hotel rooms, creating sustained demand.

Supply and Demand Imbalance: While new hotel construction has slowed, demand for quality short-term rentals continues growing. This supply constraint means well-positioned properties can command premium rates.

Technology Integration: Modern property management systems make running short-term rentals far more efficient than even two years ago. Automated guest communication, smart locks, and integrated booking platforms have reduced the operational burden significantly.

Traditional vs Serviced: The Financial Reality

Let's get into the numbers, because that's what really matters. A typical 2-bedroom flat in Manchester might generate £1,200 per month on a traditional AST. The same property, properly set up as a serviced apartment, could achieve £150-200 per night with average occupancy of 65-75%, generating £2,900-4,600 monthly.

Even accounting for higher running costs (professional cleaning, utilities, management fees), the net income often exceeds traditional rentals by 20-40%. More importantly, you maintain control over the property and can adapt quickly to market changes.

The Risk Profile Difference: Traditional rentals carry the risk of extended void periods, tenant default, and property damage that takes months to resolve. Short-term rentals spread risk across hundreds of different guests annually, meaning one bad experience doesn't devastate your cash flow for months.

Operational Considerations: Why Professional Management Matters

Here's where many landlords get it wrong: they assume they can manage short-term rentals the same way they handle traditional lets. The reality is that serviced apartments require a completely different operational approach.

Successful short-term rental management involves:

24/7 guest communication and support

Professional photography and listing optimization

Dynamic pricing strategies that respond to market conditions

Quality assurance and regular property inspections

Seamless check-in/check-out processes

Rapid response to maintenance issues

Attempting to handle this yourself while maintaining quality standards is challenging, especially as you scale multiple properties. This is why many successful landlords partner with specialized Airbnb management companies who understand the operational complexities and can optimize performance.

The Diversification Strategy That Makes Sense

Smart portfolio diversification in 2025 doesn't mean abandoning traditional rentals entirely: it means strategically combining both models to maximize returns while minimizing risk.

Consider this approach:

Core Holdings: Maintain 60-70% of your portfolio in quality traditional rentals in solid residential areas. These provide steady, predictable income and long-term capital appreciation.

Growth Engine: Allocate 30-40% to serviced apartments in high-demand locations. These properties drive higher returns and provide flexibility to adapt to market conditions.

This balanced approach gives you the stability of traditional rentals while capturing the upside potential of short-term lets. If short-term rental regulations tighten in certain areas, you can pivot those properties back to traditional lets. Conversely, if traditional rental yields compress further, you can convert more properties to serviced apartments.

Location Strategy for Serviced Apartments

Not every property suits short-term rental conversion. The most successful serviced apartments share common characteristics:

Urban Centers: City center locations near business districts, universities, or transport hubs consistently perform well. Business travelers and short-term workers pay premium rates for convenience.

Tourist Destinations: Properties near attractions, coastlines, or in historic areas benefit from leisure travel demand and can command seasonal premiums.

Transport Links: Properties within walking distance of major train stations or airports capture both business and leisure markets.

Local Amenities: Areas with restaurants, shops, and entertainment nearby attract guests willing to pay more for the complete experience.

Getting Started: The Practical Steps

If you're considering adding serviced apartments to your portfolio, start with these steps:

Analyze Your Existing Properties: Which of your current properties could work as short-term rentals? Consider location, size, and local demand.

Research Local Regulations: Understand planning permissions, licensing requirements, and any restrictions in your target areas.

Calculate True Costs: Factor in setup costs, ongoing operational expenses, and management fees to determine realistic ROI expectations.

Partner with Experts: Work with experienced short-term rental managers who can optimize your property's performance and handle day-to-day operations.

The Bottom Line

Portfolio diversification in 2025 isn't just about spreading risk: it's about positioning yourself to capture opportunities in a rapidly evolving market. The combination of traditional and serviced rentals offers the best of both worlds: steady income from long-term lets and growth potential from short-term rentals.

The landlords who thrive in 2025 and beyond will be those who adapt their strategies to meet changing market demands while maintaining operational excellence across their entire portfolio. The question isn't whether you should diversify: it's whether you can afford not to.

Ready to explore how serviced apartments could transform your property portfolio? The opportunities are there, but they won't wait forever.

HERE

HIM DECIDING TO GO FOR A

TRADITIONAL RENTAL VS USING OUR SERVICES

90%

Occupancy rate

2X

Profit comparing to BTL

9.5

Excellent on Booking.com

Godwin

"Before I came across Statera Estates I had this property vacant for 2 years. I was starting to get frustrated and was thinking about selling because I did not want to go back to dealing with regular tenants. If someone had told me 2 years ago that I could make more than double the profits on this property and not having to deal with tenants, I would have never believed them, but that is exactly what has happened. My property is looking the best it ever has, always book booked out and I never have to ask any questions because I have my own portal which allows me to see exactly what is happening at any given point. I could not recommend this company highly enough!"

USEFUL TO KNOW

Lots of landlords are unaware of the potential to increase the income they generate from their properties. So much so that a whole new income strategy has come out of this lack of knowledge, called rent-to-rent.

This is where landlords are offered guaranteed rent for a fixed term, this could be anywhere from 12 - 60 months, the landlord then allows the service provider to sublet the property, which they then turn into serviced apartments. In theory, there are benefits to the landlord, as they no longer have to worry about void periods, management, evictions etc. The difference between what the service provider

rents the property from the landlord for, and what they are able to get on the open market, is theirs to keep as profit

.

AT STATERA ESTATES, WE BELIEVE THERE IS A BETTER WAY!

Having worked with many investors, we understand the landlords journey, the sacrifices they have made to put themselves on the ladder, and as such we believe it is unfair that so many property investors and landlords are missing out on the opportunity to maximise on the investment that they’ve worked very hard to attain, while others are often times making more money from their properties than they are as landlords and investors.

GET THE MOST OUT OF YOUR PROPERTY

INCREASE YOUR CASHFLOW

MORE TIME, WE MANAGE IT FOR YOU

CUTTING OUT THE MIDDLEMAN

LEGISLATION AND TAX BENEFITS

We decided that we will focus on helping landlords get the most out of their properties and increase cash flow by managing their properties on their behalf as serviced apartments, and in the process, cutting out the middleman. This puts the control back into their hands as they are now able to benefit from all the legislation that doesn't apply to using your property as a serviced apartment.

WANT TO JOIN OUR INCREASED INCOME REVOLUTION?

TERMS &

CONDITIONS

PRIVACY POLICY

Statera Estates LTD is a company incorporated in England and Wales with registered number 14204437 and registered offices at 2627, 321-323 High Road, Chadwell Heath, Romford, Essex, RM6 6AX, United Kingdom.

Statera Estates LTD is registered with the Information Commissioner’s Office, with registration number ZB361736

Statera Estates LTD is a member of The Property Ombudsman Scheme, with membership No. T08031.